Case Story: Buying gold with silver

Sometimes spending a little produces value when spending a lot will not. This is a case study of how a fast-growing company transformed its financial operations without spending a fortune.

Our client was a company in transition. It had weathered the double-dip recession, and had a new financial leadership team in the form of an experienced CFO and an ambitious group financial controller. It had an equally ambitious growth strategy. But it had a problem: it couldn't see what was happening. In the words of the group financial controller: "I didn't trust anything. I would ask for information, and three days later it would arrive. Then the next day, it would change. I did a restructuring. The under-performers were let go, but it didn't help. We put in BusinessObjects but the project stalled, so that didn't work. No, we needed an ERP system." A budget of £1m was set.

The financial controller had prescribed a new accounting system. However, the CFO asked the team to take a step back before diving in and called in the Peter Charles team.

This is a critical and interesting point. We have seen that great finance directors develop a sixth sense. It kicks in when the obvious answer just does not feel right, when ready-fire-aim just does not feel right. We agree. Our approach is to pause, just for a moment, before time and treasure is consumed; and because we do not sell ERP systems or push other consultancy services, we are truly independent.

This is how we performed alchemy.

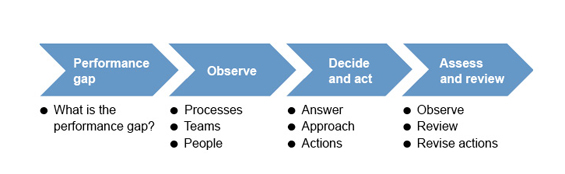

Step 1: Find the gap

We formed a project team and, alongside the client's management team, outlined the main performance gaps.

The most critical were high transaction reperformance and a disconnect between finance and front-office teams. Since neither gap was about accounting software, the decision to pause was borne out and suggested that the problem lay elsewhere.

Step 2: Observe and understand

Now, we looked at business processes. We did this to identify the reasons for the gaps. It was revealing. It showed obeisance without understanding, and processes built out of the ad hoc. Recent change programmes, rather than replacing and improving, simply lay on top of previous processes. BusinessObjects, partially implemented, lay on top of everything. A waste of a good system.

The one thing our review did not show was a broken accounting system. Misused, yes, but functional.

Alongside this we checked to understand how the finance team worked with the business. It didn't. The review identified that the finance team placed impossible requirements on the sales and operations team through over-complex approvals processes, and the commercial teams saw little point in their finance colleagues because of their focus on reporting and not partnering. Yes, there were finance managers embedded in the divisions, but they were so anxious to be accurate to the pound that they made mistakes in the tens of thousands, causing the persistent reissuing of information. The review also highlighted team bottlenecks, leading to delays, underperformance and poor use of resources.

Step 3: Decide and act

The Peter Charles team presented its recommendations to the CFO. The principal recommendations were to change the shape of finance in the business by creating a shared service centre (SSC). Getting rid of sources of conflict was important: rather than expecting the business to become accountants by outsourcing the coding of invoices, it was taken back in, and done right first time.

No less important was the transfer of all accounting from the divisional finance managers to a central team; rather than spending their time on the preparation of accounts, they could now partner the business properly and thus focus on providing analysis for commercial decision-making.

The third recommendation was to streamline processes in the new SSC, eliminating irrelevant processes and bad practice.

Eliminating the excessive use of Excel was the fourth recommendation, and a BusinessObjects project implementation document was laid out.

| Symptom | Reason | Solution |

|---|---|---|

| Reperformance of work | Poor transaction processing | Right staff do right first time and do not expect operations specialists to become accountants |

| Poor partnering | Finance managers focus excessively on accounting | Transfer management accounting to central team. Everybody to do one job, and to do it well |

| Inefficient processing | Lack of management control and organic growth of practices | Remove irrelevant processes, and get it right first time |

| Inconsistent information | Ad hoc reports | Commit to making BusinessObjects a single source of truth |

| Everything last minute | Bottlenecks | Remove a line of management |

The implementation, including restructuring, took eight months.

Step 4: Assess and review

Before the changes were completed, the impact was obvious. The team, because they were doing the right job, in the right way, delivered; and, without bottlenecks, information quality and speed improved. What's more, the relationship between the finance team and the business improved dramatically. Freed of accounting, the finance managers had time to become partners, and because they were seen to be partners, they were able to influence and deliver best practice.

As data availability and quality increased, so did demands: the scope of BusinessObjects was extended.

Outcome

In the end, our client did not buy the ERP system. They did not spend their £1m. They did not need to. Instead, the Peter Charles team led the client to deliver outstanding performance for a fraction of the sum, and in a third of the time.

Lessons learned

We believe that the right approach for critical projects is to understand the root causes of a problem, to realise that processes, relationships and people are also part of the answer, and to remain on-site to respond to opportunities. This approach forms a significant part of successful problem solving. The ready-fire-aim approach is decisive, but often misses the real issues.

Related Content

Case Stories

- Case Story: Resurgence of a dotcom

- Case Story: Managing a successful separation

- Case Story: The only constant is change

- Preparing for growth

- Case Story: Financial forecasting model for a scientific invention

- From negative to positive